If you examine the recruitment boards of Microsoft, SAP, or Google today, you will notice a distinct shift in capital allocation. These technology giants are no longer just hiring Engineers and Data Scientists. They are aggressively recruiting “Strategic Storytellers.”

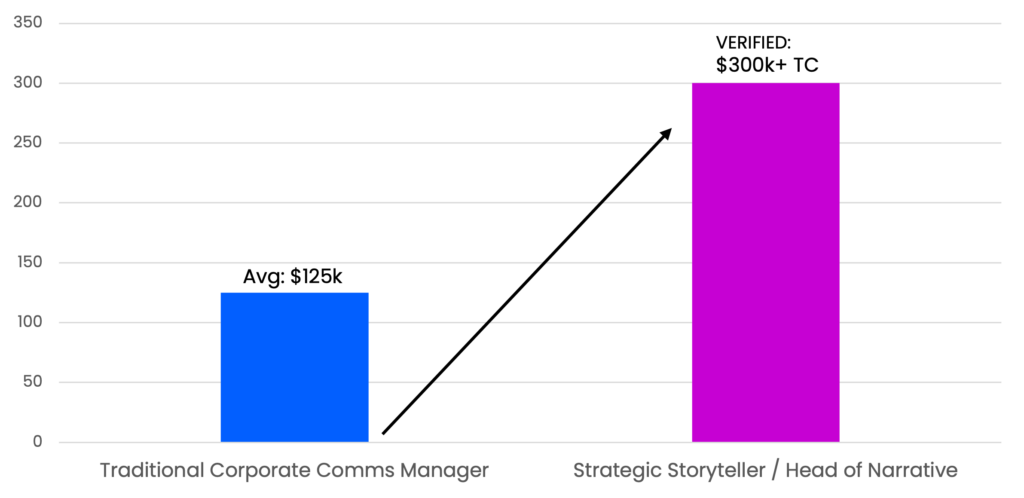

The compensation for these roles—often titled Head of Storytelling or Director of Executive Communications—frequently exceeds $300,000 in Total Compensation.

A bar chart comparing “Traditional Corporate Comms Manager” (Avg: $125k) vs. “Strategic Storyteller / Head of Narrative” (Verified: $300k+ TC)

To the traditional CFO, this line item might appear exorbitant. Why would a technology infrastructure company pay a quarter-million dollars for “storytelling”?

The answer lies in a fundamental shift in the 2026 market dynamics: Valuation now follows Narrative.

The Death of the "40-Slide PDF"

For the last decade, enterprise leaders and founders raised capital using a standard, utilitarian toolkit: a dense 40-slide PDF and a quarterly earnings call centered on retrospective data. This approach functioned adequately when capital was cheap and decision cycles were long.

That era has closed.

Today, investors—whether institutional or private equity—underwrite your Thesis, not just your Internal Rate of Return (IRR). In a saturated market, if two companies present identical revenue figures, the organization with the compelling, inevitable vision commands the higher valuation multiple.

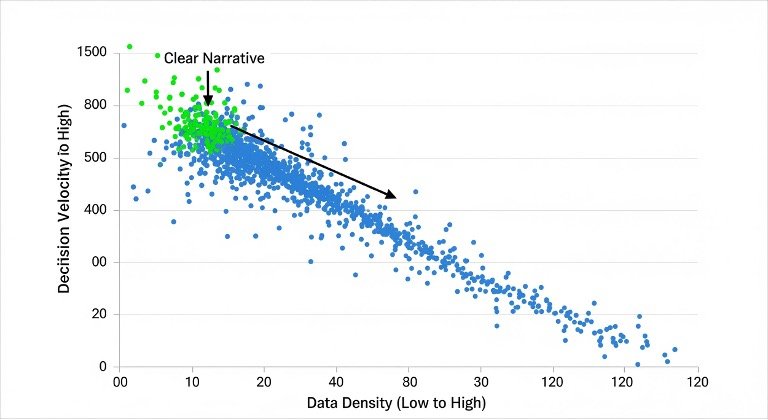

A correlation graph showing “Data Density” vs. “Decision Velocity.” High density = Low Velocity. High Narrative = High Velocity.

This is the “Insight to Action Gap“. Companies often possess the data but fail to translate it into a narrative that drives decision velocity.

Why "Owned Narrative" is the New Asset Class

Reliance on “earned media” to explain your business model is a liability. Market leaders control their own narrative.

Consider Microsoft’s pivot. By controlling their story and rigorously rebranding as the “AI Infrastructure” layer, they did not change their balance sheet overnight—they changed how the market interpreted their future cash flows. The result was a historic appreciation in stock value.

Conversely, US businesses lose an estimated $1.2 trillion annually due to ineffective communication (Source: Grammarly/Harris Poll). When a narrative is unclear, the market assumes risk, and valuation suffers.

The "Slide Deck" vs. The "Strategic Asset"

A critical error observed in mid-cap and even Fortune 500 companies is treating the Annual Report or Investor Deck as “Administrative Work.”

Delegating your primary capital-raising asset to a junior designer is a fundamental misallocation of resources. It applies a $500 solution to a $500 Million problem.

A true Investor Narrative is not about design decoration; it is about Strategic Architecture. It must answer three questions with absolute precision:

- The Conviction: Why is this market opportunity mathematically inevitable?

- The Gap: Why is your team the only entity capable of capturing it?

- The Infrastructure: How does your operational machine function?

The Science of Retention

This approach is backed by cognitive science. Research from Stanford University indicates that stories are remembered up to 22 times more than facts alone (Source: Stanford Graduate School of Business).

When a CFO presents a “Data Dump”—slide after slide of spreadsheets without a narrative arc—the audience retains a fraction of the information. When that same data is wrapped in a strategic narrative (Situation, Complication, Resolution), it becomes a decision-enabling asset.

The A1 Slides Philosophy: Narrative Systems

At A1 Slides, we function as Strategic Thought Partners.

We believe that high-stakes capital events require a partner who understands the balance sheet as well as the storyboard.

We utilize Insight First DesignTM principles, ensuring that:

- The Insight is the Hero: The key takeaway drives the slide.

- Design is the Guide: Visuals exist solely to reduce cognitive load and accelerate understanding.

Closing Thought

Ask yourself: Is your current Investor Deck protecting your valuation, or is it simply reporting your past?

In the current economy, clarity is not a “soft skill.” It is a strategic advantage. If you are ready to treat your narrative as an asset class, we should speak.